The latest three world slogan from the Coalition party in Australia is – ‘Jobs and growth’. As far as three world slogans go, it’s pretty inoffensive. And despite Malcolm Turnbull’s silly claim that the Labor Party is “anti-growth” and wants to destroy jobs, I think most people can agree that all political parties aim to increase jobs and growth.

So what does the Coalition specifically have in mind, and why am I writing about this? Well, the answer to both is the usual MO of this blog – neoliberalism. That the conservative Coalition government is enamoured with neoliberalism is no surprise. What I am finding surprising, though, is the brazen reasoning it is giving for its policy of a $50 billion tax cut for corporations over ten years.

While an argument could be made (and I’ll address it later) that Australia’s corporate tax rate needs to be lower to compete with our competitors in the OECD, this isn’t the primary argument the Coalition is making. The main line of reasoning they are pursuing is the good old neoliberal canard: trickle-down economics. That is, if we reduce regulations and taxation on the rich and big business, then the savings they enjoy will allow them to employ more people, and eventually the resultant economic growth will flow onto the broader community. Simply, this is the concept of ‘a rising tide lifts all boats’.

On the face of it, this is a fairly reasonable argument. If you tax or regulate people/businesses more – they are less likely to undergo growth activities. Tax or regulate them less – they will do more of that activity. And while incentives aren’t as simple as calculations regarding what choice leads to more money, it’s clear that it plays a significant part. Not least in a competitive profit driven system like capitalism.

But for this to work at a larger economy-wide scale a few assumptions have to be made. First – that it is businesses that drive growth more so than consumers (what’s broadly called supply side economics). Second – even if businesses can and do largely drive growth, that the reduced tax burden will actually be invested back into the business instead of being passively saved or stuffed under the proverbial mattress. And third – that any actual increase in economic wealth that might occur is shared somewhat equitably across society.

And as it turns out, these three assumptions have proven to be largely wrong over the last 35 years of the neoliberal experiment. I’m not so interested in the ‘why’, I’ll leave that for the social scientists and economists to work out. I’m more interested in showing that after 35 years of this experiment, there is ample evidence to suggest that it is a flawed model, despite it’s fairly ‘common sense’ logic. And that it is incredibly brazen that the Coalition party is attempting to foist this nonsense on our country with renewed vigour, not least after the disaster of neoliberal economics in the global financial crisis (GFC).

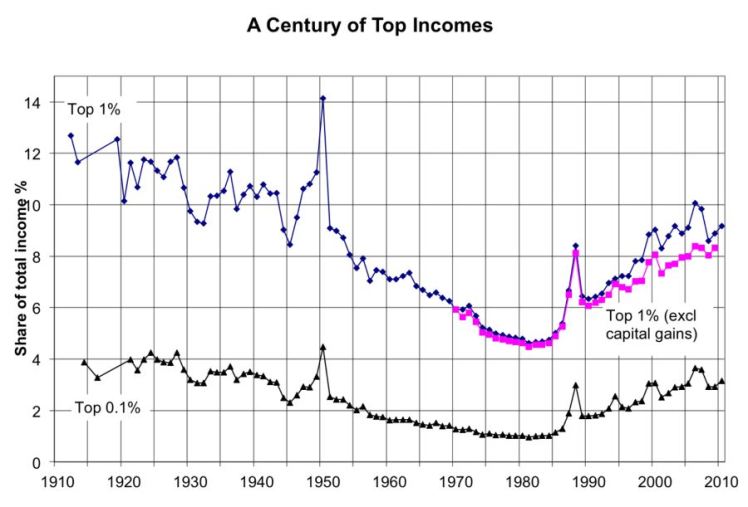

So, what have we seen over the last 35 or so years since Margaret Thatcher in the UK and Ronald Reagan in the US turned the world on its head? The least surprising result of reducing taxes and regulations for the wealthy is increasing inequality. In Australia, in the 25 years up to 2010, real wages increased by 50% on average but by only 14% for those in the bottom 10%, and 72% for those in the top 10%. The share of earnings of the top income earners in Australia over the period of nearly 100 years can be seen below. The ratio of earnings of the top earners fell gradually until about 1985 (the start of the neoliberal experiment in Australia), at which point the trend reversed right up to the GFC:

The same trend can be seen in the UK, and in the US (for wealth).

A similar, yet more extreme situation is reflected in wealth distribution. On a worldwide scale the figures are truly astounding. In 2010, 388 individuals had the same wealth as the poorest half of humanity (3.6 billion people). In just five years that disparity had grown such that only 62 people had the same wealth as the poorest half of humanity.

So, unsurprisingly, inequality has grown since the inception of neoliberalism in the early 1980’s. Is this a problem? Many on the right claim that objecting to this fact equates to envy of the rich, or even more hyperbolically – class warfare. Whether it does or not (I’d suggest it’s nothing of the sort), is irrelevant given that there is significant real world data suggesting that higher inequality equates to reduced economic growth. This is in direct contradiction to the neoliberal claim that reducing taxes and regulations (and thereby increasing inequality) leads to higher economic growth rates.

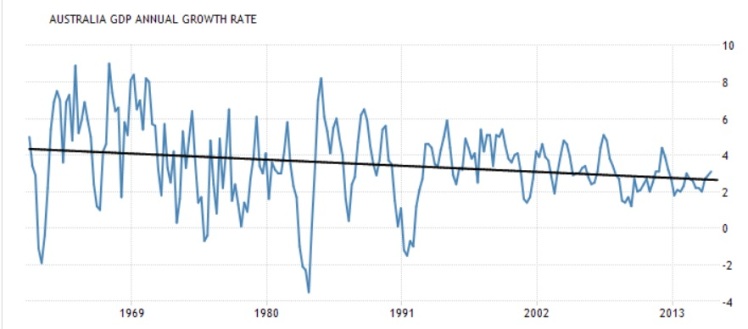

When we look at the period between World War II and the advent of neoliberalism in the late 70’s, and compare it to the post 1980 period, we find that growth rates have reduced under neoliberalism. Below is a graph of Australian annual GDP growth rates over the last 55 years or so:

And while there is considerable variation in growth rates, it’s clear that growth rates have been declining on average since the 70’s. Interestingly, variability in growth has clearly declined after the early 90’s, something which can also be seen in the equivalent US data. This could be seen as a positive, and I’m unsure of why this has come to pass. As an aside, in terms of a sustainable economic system and biosphere, unending growth obviously isn’t a very desirable thing (unless it is decoupled from unsustainable resource use). But from a neoliberal perspective, which asserts that neoliberal practices lead to higher growth rates, considering GDP rates over time becomes important to determine the validity of that ideology.

From the data (above) and modelling (OECD, IMF), it seems clear that neoliberal policies don’t lead to higher economic growth rates. This would seem to suggest that the first two assumptions (business, as opposed to demand, drives economic growth; and business constructively reinvests any tax savings) are off the mark as well.

Related to the second assumption is the other part of the Coalition’s three word slogan – ‘Jobs’. If businesses were reinvesting tax savings into the business we might expect to see increased employment across the economy. Although, countering this, are automation technologies and productivity improvements via other mechanism. What is ‘productivity’? When applied to workers, simply, it’s working harder and/or smarter. So growth can occur without an increase in employment. However, let’s not forget that the Coalition is arguing that its corporate tax cut will lead to higher employment (or perhaps just maintaining contemporary employment rates?).

When we look at employment, we see some (on the face of it) good news. Unemployment is at 5.7%, well below the long term average over the last 40 years of just under 7%. And the employment rate has been on an impressive upward trend since the advent of neoliberalism. Unfortunately, these figures don’t give an accurate picture of the underlying reality. And an uncritical media pump these figures out and allow politicians to claim these as positives, as if they convey anything near the full story of employment in Australia (and the world).

So what is the underlying reality? Well, real employment is actually falling. This can be seen by measuring the average hours worked per month by each employee and tracking it over time. This takes into account rising workforce participation due to population growth, later retirement age and, most significantly, increasing workforce participation by women.

Incidentally, did you know that ’employment’ is officially considered working only one hour per week? How accurate do you imagine an ‘official’ (un)employment figure can be when such little activity can be included as ’employment’?

So, why is employment falling? Well productivity increases explain a chunk of that. Automation, and employees working harder and smarter, means businesses need less employees for the same output. Output, of course, ideally never stays the same. It grows. But if output can be grown and profits maximised with less employees, then less employees is what results.

But productivity isn’t the whole story. There has been a significant shift away from full-time jobs to part-time/casual jobs. Some of the growth in part-time jobs reflects the increasing participation of women in the workforce. But the critical shift has been a reduction of full-time employment:

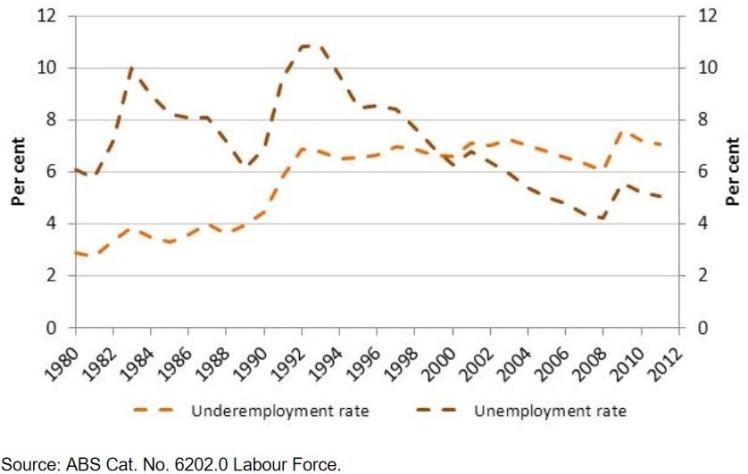

In right-wing speak, this is often described as “flexibility”. The implication being that workers are choosing to work less and live more. In some situations this is undoubtedly the case, but personal debt has exploded in Australia, suggesting that most people probably aren’t in a position to reduce their employment hours by too much. And indeed the data shows that employment is being constrained. Looking at the ‘underemployment’ figure, which in the following graph includes only employed people wanting more work (normally it is unemployment and insufficiently employed combined), we can see the clear rising trend over time:

So while ‘official’ unemployment has been falling, and the media and politicians have been crowing this result, the reality is the opposite – real employment has fallen and people want to be working more.

As a final remark, I mentioned earlier that there is a potential argument that can be made regarding the global competitiveness of the Australian corporate tax rate. In a globally interconnected capitalist system, competition for investment is a real concern, just as competition for investment is critical within a nation. If a nation’s corporate tax rate is too high in comparison to its competitors, then all else being equal you’d expect less investment in the higher taxing country. Two things to say about this:

One, compared to our G12 competitors, our corporate tax rate is not largely different. Our current rate of 30% compares fairly well to the G12 average of 28% (including the US at 39%). And, of course, a significant proportion of large corporations pay little to no tax in Australia, which means that the official tax rate is essentially meaningless to them anyway.

Secondly, and most concerning, by adopting a competitive approach to setting our corporate tax rate, we both cede some of our national policy sovereignty to other nations, and we enter into what’s commonly known as ‘a race to the bottom’. That means that to maintain a competitive advantage, every nation has to continually cut their tax rates. The ultimate logical end to that is a tax rate of 0%. Of course, national economies would fail well before that point, but a failure point will by necessity be reached one day by all nations if we continue in a race to the bottom scenario. Arguably, we are already basically at this point in regards to the whole taxation system, given the structural deficit most western nations find themselves in. That is, decades of neoliberal tax cuts have left our economies unable to generate enough revenue to fund the services we all demand. And I would strongly argue that our economies are failing right now. The global financial crisis is the most visible example of that – sky rocketing private and government debt necessary to fund the services we need reached unsustainable levels. Ironically, the most effective nations (like Australia) in countering the effects of the GFC employed pre-neoliberalism demand-side economics to ‘pump prime’ demand and mitigate the worst effects.

And yet, even after this economic calamity, it seems the neoliberal ideologues are determined to continue on with their perverse social experiment, slashing taxes in Australia, and slashing government spending in other nations such that basic services that we demand are under threat of being disbanded. At present I am fairly optimistic that we will at least temporarily put a stop to this madness in the near future. The rise of Jeremy Corbyn in the UK, Bernie Sanders in the US, and the Greens and independents (and indeed a resurgent progressive faction in the Labor party) in Australia gives me hope that we might knock this on the head before it does too much more extreme damage. But I doubt, even if this rallying of progressivism and rational policy prevails, that the fight in the neoliberal dog is dead. It’s going to be a long battle.